In the ever-evolving world of investment, blue chip art stands apart—an asset class that merges cultural capital with financial longevity. Coveted by top collectors, sought after by museums, and regularly breaking records at auction. It represents the apex of value, prestige, and permanence in the art market.

What Is Blue Chip Art?

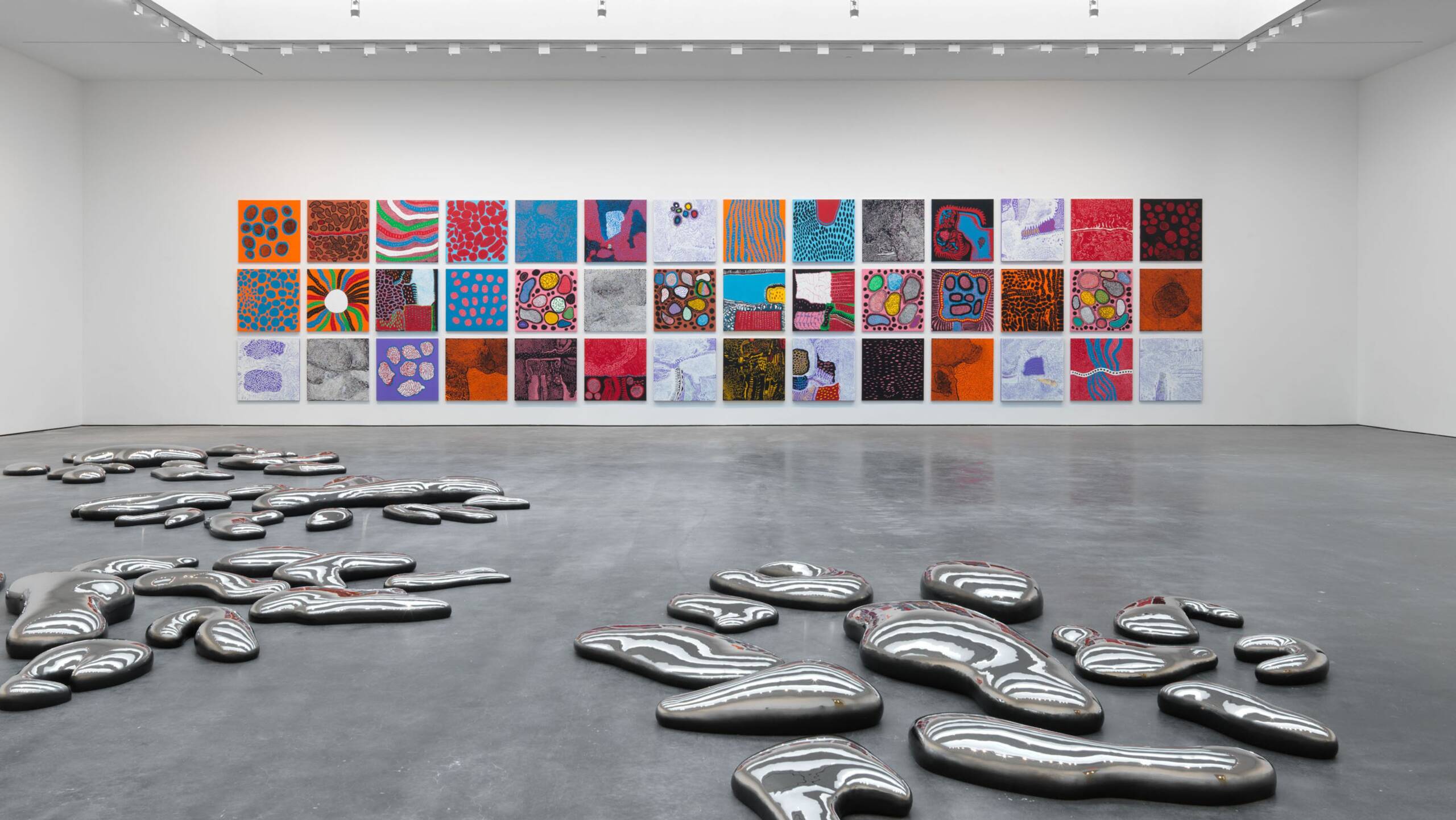

Much like its namesake in finance, blue chip art refers to artworks by established, historically significant artists with a consistent record of high demand and value retention. Think: Jean-Michel Basquiat, Andy Warhol, Yayoi Kusama, Gerhard Richter, Agnes Martin.

These are the names you see in major museum collections, international art fairs, and headline-grabbing auctions. But what distinguishes blue chip art isn’t just fame—it’s proven performance over time, broad collector appeal, and rarity.

Why Invest in Blue Chip Art?

Unlike more speculative market segments, blue chip works offer stability. It’s relatively insulated from short-term trends. Often times, it appreciates significantly over the long run. In an uncertain economic climate, many turn to art not just for its aesthetic pleasure, but for its resilience as a tangible, non-correlated asset.

But perhaps the greatest benefit? The artwork carries cultural weight. These works tell stories that outlive market cycles. They reflect defining eras, challenge norms, and preserve the legacies of the artists who shaped art history.

How AXIOM Fine Art Consulting Adds Value

At AXIOM Fine Art Consulting, we offer more than access—we provide expertise. Our advisors navigate the blue chip art market with discretion and insight, sourcing exceptional works that align with your investment strategy. From identifying the right blue chip artworks to verifying provenance and negotiating private acquisitions, AXIOM handles every step with integrity and precision.

We also help you position your collection for the future. Whether that means safeguarding long-term value through conservation and framing or advising on resale strategies when market timing is optimal.

Through our relationships with international galleries, auction houses, and private collectors, we secure access to blue chip art that rarely appears publicly. And because we pair market data with connoisseurship, we deliver more than opinions—we offer perspective.

A Portfolio with Purpose

Whether you’re a seasoned collector or entering the market for the first time, investing in art requires more than interest—it requires strategy. At AXIOM Fine Art Consulting, we believe in building collections that hold both personal and financial significance.

Because true investment isn’t just about return—it’s about legacy.

Looking to begin or expand your blue chip art collection?

Connect with AXIOM Fine Art Consulting for private acquisitions, strategic guidance, and access to the world’s most sought-after works.