Axiom Blue

Art as an Asset

Explore the intersection of cultural enrichment and financial growth by investing in blue chip art.

Investing in Blue Chip Art: The Smart Collector’s Guide

Why Blue Chip Art Is a Cornerstone of Savvy Collections

In the ever-evolving landscape of fine art, investing in blue chip art has become a hallmark of both prestige and financial intelligence. Blue chip artworks—created by renowned, historically significant artists—are widely recognized for their enduring market value. These works are the Picassos, Rothkos, and Warhols of the art world. They represent time-tested names with consistent demand and strong performance at major auctions.

For collectors, designers, and investors alike, blue chip art offers a compelling combination of aesthetic excellence and portfolio diversification. Furthermore, with the global art market reaching record highs, the opportunity to build or enhance a collection has never been more strategic.

What Defines Blue Chip Art?

Not every masterpiece earns blue chip status. However, these artworks typically share several defining characteristics:

Created by established, historically important artists

Provenance supported by gallery or auction house records

Included in museum collections or prestigious exhibitions

Demonstrated long-term appreciation in value

Recognized for their cultural significance

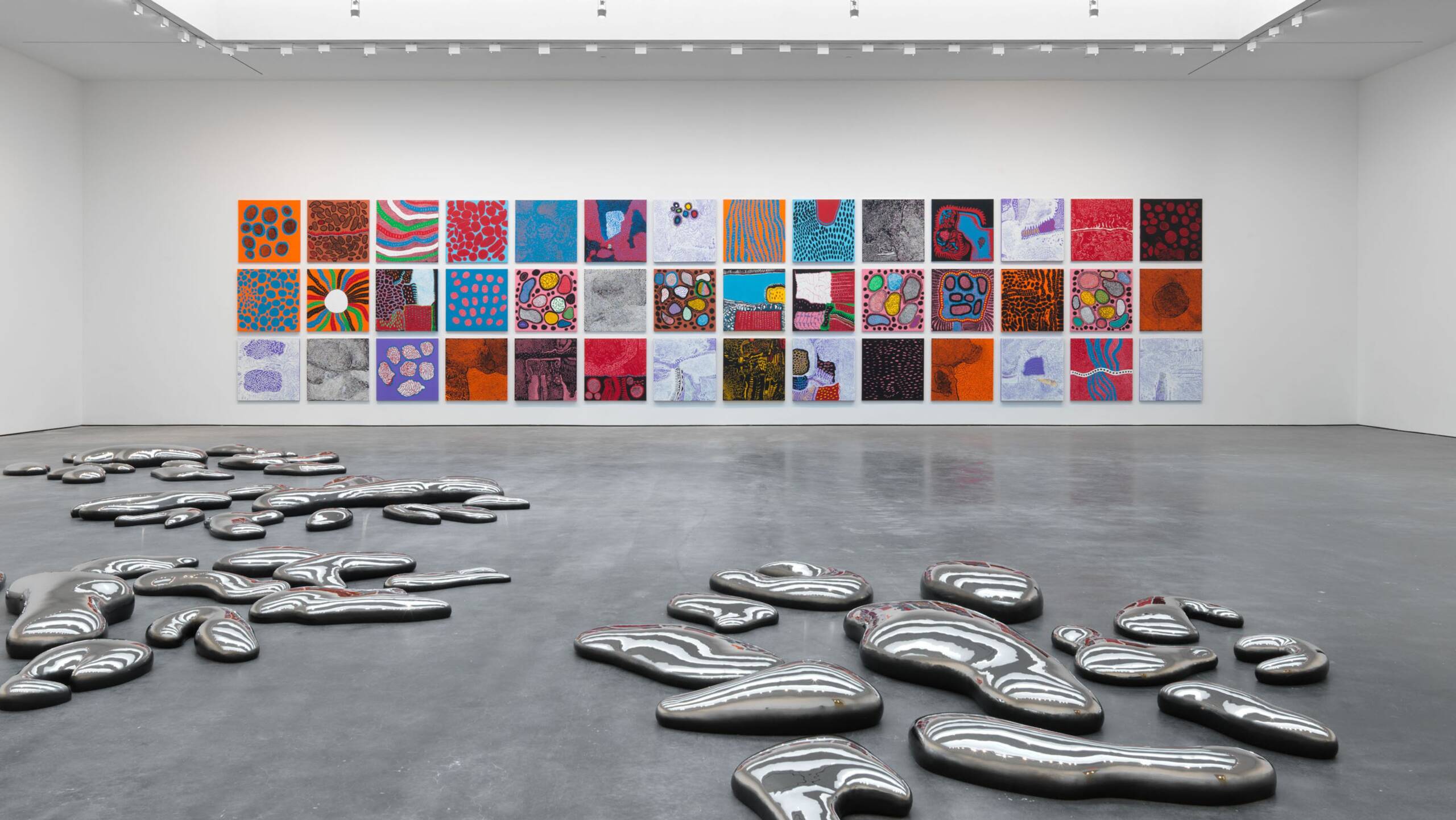

Blue chip artists include names like Joan Mitchell, Jean-Michel Basquiat, Agnes Martin, and Yayoi Kusama. Their works not only shape art history but also anchor collections with enduring value.

The Financial Upside of Collecting Blue Chip Art

Unlike emerging artists whose market presence is still evolving, investing in blue chip art provides a sense of stability. These works have a track record of resilience, especially during economic downturns. In many cases, they are viewed as a hedge against inflation.

In addition, they are less likely to depreciate due to their established reputations and consistent global demand. Recent auctions reflect this strength. For example, Sotheby’s and Christie’s saw record-breaking blue chip sales in 2023, reinforcing their appeal as tangible assets.

How AXIOM Fine Art Consulting Supports Blue Chip Investments

Navigating the blue chip market requires insight, discretion, and access. These are qualities AXIOM Fine Art Consulting brings to every client relationship. From sourcing museum-quality works to advising on authentication and provenance, we guide clients through each step of the acquisition process.

Moreover, we collaborate with top galleries, auction houses, and private dealers around the world. This ensures we secure artworks that elevate collections while supporting long-term investment goals.

Beyond the Purchase: Curation with Purpose

At AXIOM, our approach extends beyond acquisition. We work closely with collectors, designers, and developers to create environments that celebrate the emotional, historical, and financial resonance of blue chip works.

For instance, whether we’re integrating a Cy Twombly into a Palm Beach residence or pairing a Helen Frankenthaler with contemporary architecture in Los Angeles, our curations tell layered stories through exceptional art.

Ready to Begin Investing in Blue Chip Art?

If you’re looking to elevate your collection with historically significant, investment-grade works, AXIOM Fine Art Consulting is ready to help. Contact us to discover how investing in blue chip art can support your design goals, financial strategy, and long-term vision.

Dare to redefine art investment.

Download our deck and craft a narrative that disrupts the norm.